this is part of Covidnomics. For more information go to www.ooberkidsrepublic.com

Pinned to

87

0

0

|

|

Created by cecilia valente

over 4 years ago

|

|

Close

|

|

Created by cecilia valente

over 4 years ago

|

|

When we decide what to do with our MONEy

We take

FINANCIAL DECISIONS

* Choosing a Saving Product is a financial decision

* The word 'Saving' is Latin for 'salvus' or 'safe'

* It is also a matter of economics because you pay an opportunity cost (you give up buying something to save)

Before selecting a saving product, you should

* Pay off your debts

* Build up an emergency fund for urgent expenses (dentist bill, boiler repairs, temporary loss of work)

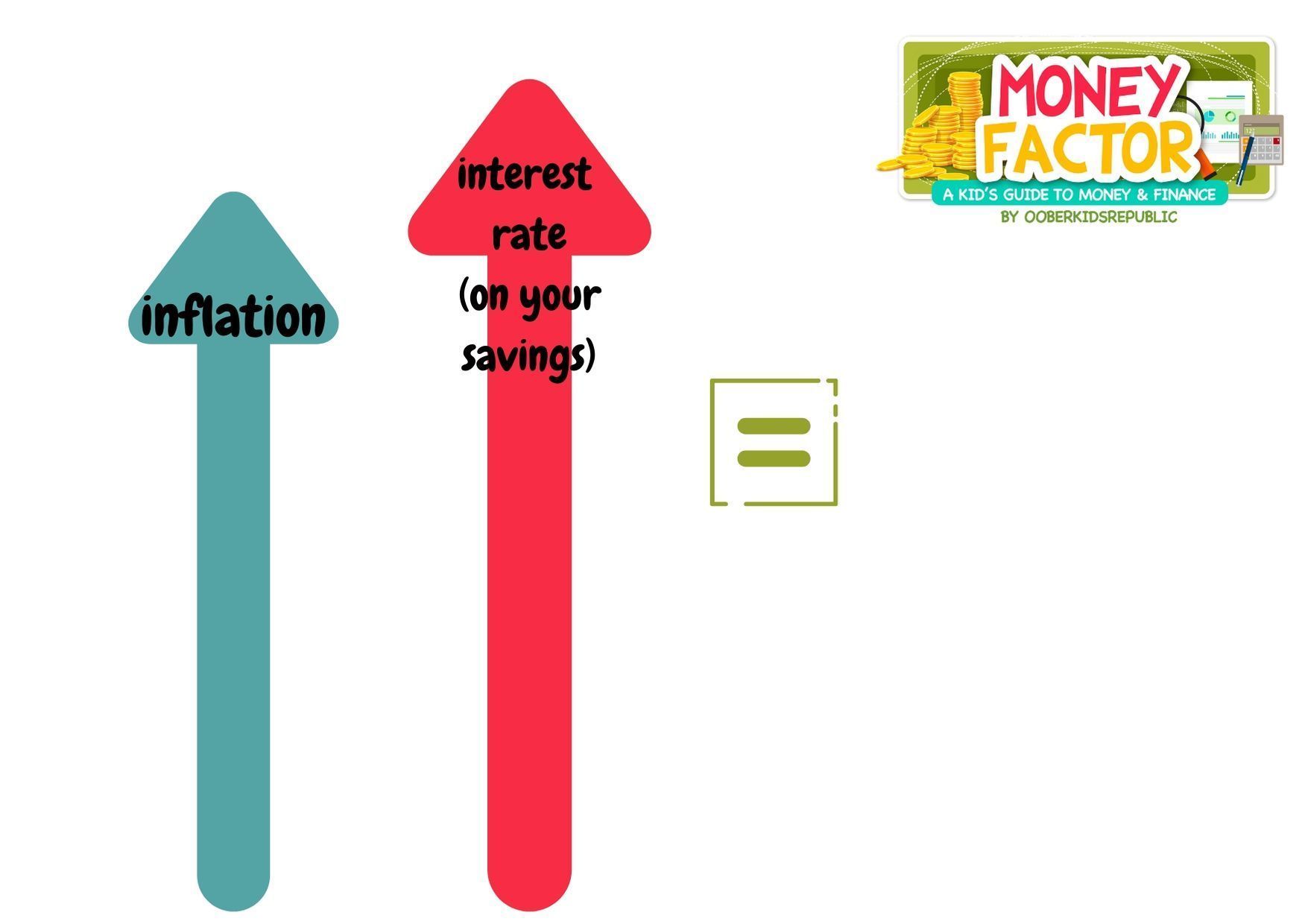

* Check the inflation rate (how fast prices are rising)

The right saving product

* Beats inflation (the interest rate it offers is higher than the inflation rate)

Time Horizon

If you are saving for an event taking place or something you need...

* within three years - your time horizon is SHORT

* between three and five years - your time horizon is MEDIUM

Examples of Financial Plans for the Short Term

* your annual holiday

* Christmas presents

* urgent need: for example buying a new car/bike (the one you have cannot be used much longer)

WATCH INFLATION

Examples of Financial Plans for the Long Term

* buying a property

*paying for further education (university)

* funding a special project (start a business)

Hide known cards

Hide known cards