Close

legal officer who represents a country or a state in legal proceedings and gives legal advice to the government.

It is a contract between you and the insurance company. You agree to pay the premium and the insurance company agrees to pay your losses as defined in your policy

Person or organization named by a policyholder to receive the death benefit of an insurance policy after the policyholder's death.

Certificate of debt issued by a corporation or government.

Stock that has voting rights and receives dividends declared by the company

Fraudulence use of someone else’s credit card information

a report detailing a person's financial history specifically related to their ability to repay borrowed money.

a specified amount of money that the insured must pay before an insurance company will pay a claim.

a long and severe recession in an economy or market.

offers income protection to individuals who become disabled for a long period of time, and as a result can no longer work during that time period.

Moral principles and beliefs that direct a person’s behavior

the international exchange of goods and services that is expressed in monetary units of account (money).

a type of insurance coverage that pays for medical and surgical expenses incurred by the insured.

a savings account used in conjunction with a high-deductible health insurance policy that allows users to save money tax-free against medical expenses abbreviation HSA.

the fraudulent acquisition and use of a person's private identifying information, usually for financial gain.

a general increase in prices and fall in the purchasing value of money.

form of risk management by which a company provides compensation for specified loss, damage, illness, or death in return for payment of a premium.

current or future financial obligations

insurance that pays out a sum of money either on the death of the insured person or after a set period.

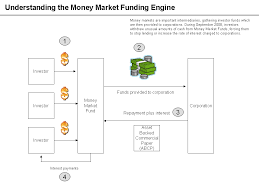

an open-ended mutual fund that invests in short-term debt securities such as US Treasury bills and commercial paper.

an investment program funded by shareholders that trades in diversified holdings and is professionally managed.

stock that entitles the holder to a fixed dividend, whose payment takes priority over that of common-stock dividends.

an amount to be paid for an insurance policy.

The risk of theft, loss, or damage to your real or personal property.

a risk with a possibility of a loss with no possible gains

Hide known cards

Hide known cards