Financial context- general, international aspects, discounting and investment appraisal

Pineado a

124

1

0

Sin etiquetas

|

|

Creado por Carley O'Connor

hace más de 6 años

|

|

Cerrar

|

|

Creado por Carley O'Connor

hace más de 6 años

|

|

THE FINANCIAL SYSTEM

Financial Markets

Stock Market

Money Markets

Financial Intermediaries

Risk Reduction

Aggregation

Maturity Transformation

Financial Intermediation

Most lenders wish to offer their funds for the short term whereas most borrowers want to borrow over the longer term. Resolving this mismatch is known as:

A) Risk reduction

B) Aggregation

C) Maturity Transformation

D) Pooling

Working Capital

Investment Capital

Asset Management Function

Sources of Finance: Long-term

Sources of Finance: Short-term

Surpluses & Deficits

Financial Needs: Organisations

Surpluses & Deficits

Financial Needs: Individuals

Surpluses & Deficits

Financial Needs: Goverments

Mezzanine Finance

ABC Chocolate manufactures a range of different chocolate novelties for sale in major supermarkets. It has seasonal trade and finds the period before Christmas difficult from a cash management point of view as it has to pay out wages and for ingredients before the holiday period but often has to wait until the New Year before receiving payment from major customers.

Which of the following would be a suitable way of managing this cash flow problem?

A) Issue new equity shares

B) Overdraft

C) Leasing arrangement

D) Mortgage

In recent years FGH, a high-end furniture retailer, has appeared to favour mezzanine finance to alternative forms of finance. What is meant by the term 'mezzanine finance'?

A) Short-term loans to help a firm through cash flow crisis

B) Foreign currency loans

C) Loans by non-financial institutions

D) Finance that is neither pure debt nor pure equity

Financial products:

EQUITY (ordinary shares)

Financial products:

BONDS

Financial products:

CDs (Cert. of Deposit)

Financial products:

Credit Agreements

Financial products:

Mortgages

Financial products:

Bills of Exchange

TUL have surplus funds that they wish to invest. Which of the following would be the least risky investment?

A) Certificates of Deposit form a global bank

B) Equity shares in a new growing company

C) Unsecured loan stock

D) National lottery tickets

Yields on Bonds

Yields on Equity

Pumpkin has $100 stock with a market price of $80 and a dividend of $5. It will generate a yield of:

A) 5%

B) 8%

C) 6.25%

D) 12.5%

Suppose a company wants to issue some bonds and is concerned about the level of return it will receive. Which of the following yields does not need knowledge of a bond's market value to calculate it?

A) Running yield

B) Gross redemption yield

C) Bill rate

D) Interest yield

Central Rate of Interest

Real and Nominal Interest Rates

AUSL is considering an investment within the year. They are concerned about interest rate volatility. Which of the following are the likely consequences of a fall in interest rates?

(i) A rise in the demand for consumer goods.

(ii) A fall in investment.

(iii) A fall in government spending.

(iv) A rise in the demand for housing.

A) (i) and (ii) only

B) (i), (ii) and (iii) only

C) (i), (iii) and (iv) only

D) (ii), (iii) and (iv) only

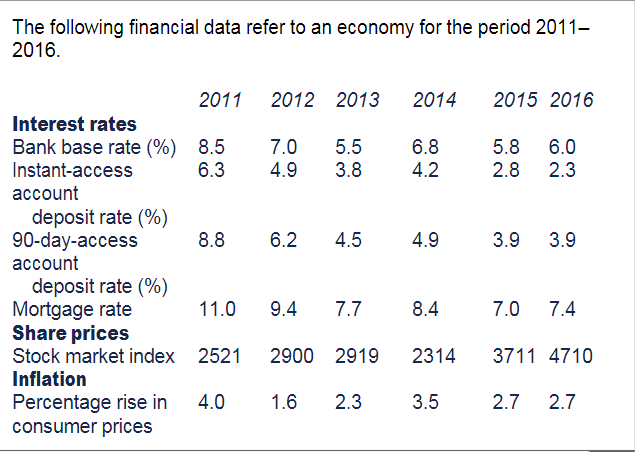

(i) Using the bank base rate, calculate the real rate of interest for 2013.

(ii) Calculate the real mortgage rate of interest for 2014.

(iii) State whether real share prices rose or fell between 2012 & 2013.

True or False.

Rising real interest rates will encourage savings and investment.

True or False.

Interest rates will only affect business investment if that investment is financed by borrowing.

True or False.

Rising interest rates in a country tend to raise the exchange rate for that country’s currency.

True or False.

Producers of consumer durable goods are more sensitive to changes in interest rates than supermarkets.

True or False.

Central banks cannot increase the money supply and raise interest rates at the same time.

State whether the effect of a rise in interest rates will be to:

Increase or Decrease gov't spending

State whether the effect of a rise in interest rates will be to:

Reflate or Deflate the economy

Which one of the following is not a function of a central bank, for example the Bank of Japan?

A) Management of the National Debt

B) Holder of the foreign exchange reserves

C) The conduct of fiscal policy

D) Lender of the last resort

What is Cash ratio?

What is the relationship between liquidity & profitability of banks assets?

How could a central bank reduce the supply of credit in the financial system?

How could a central bank reduce the demand for credit in the financial system?

What are capital adequacy rules?

Which of the following would be expected to lead to a rise in share prices on the Hong Kong stock exchange?

A) A fall in interest rates

B) A rise in the rate of inflation

C) A fall in share prices in other stock markets

D) An expected fall in company profits

A 30 year Treasury bond that was issued last year is sold in a:

(i) money market

(ii) capital market

(iii) primary market

(iv) secondary market

A) Both (i) and (iii)

B) Both (i) and (iv)

C) Both (ii) and (iii)

D) Both (ii) and (iv)

The function of linking net savers and net borrowers is:

A) known as the credit multiplier

B) one of the functions of money

C) solely the function of the capital market

D) called the financial intermediation

A bond with a nominal value of $1,000 has coupon rate of interest of 6% and market value of $1,200.

Calculate the yield on this bond.

Ocultar las fichas que te sabes

Ocultar las fichas que te sabes